October - December 2023

Indiabulls

Facing challenges with their CRM system, we conducted research and provided recommendations for improved efficiency and user satisfaction

Frustrated by slow response times, data integration issues, and unreliable support, Sales, Credit, and Customer Service departments across organizations struggled with a subpar Microsoft D365 experience. Recognising this, Microsoft launched a 3-month UX research project to assess D365 user adoption and identify additional challenges.

As part of a cross-functional team, I played a key role in crafting interview questions, conducting user immersions (firsthand observations), and analysing user interactions with the Housing Finance and CRM portal functions. Through data analysis and collaboration with the technology team, we proposed solutions aimed at improving user experience and streamlining processes.

Platform

Microsoft 365 ( CRM )

Timeline

3 months

Role

UX researcher

My role

As a UX researcher on a 3-month project with the Experience, Technology, and CRM Portal teams, I crafted interview questions, conducted user immersions, and studied the Housing Finance process and CRM portal interaction. My role included data sorting and compilation, leading to proposed solutions in collaboration with the technology team to enhance user experience and streamline processes.

Research methodology

The research methodology incorporated diverse techniques, encompassing ethnographic research for in-depth cultural insights, observational research for real-time behavioral understanding, and surveys/questionnaires for quantitative data collection. This comprehensive approach facilitated a nuanced exploration, yielding valuable insights into user experiences, preferences, and behaviours across various dimensions.

Lets deep dive into the issues faced by different teams

Credit team

Process followed by the credit team

.png)

Persona for credit

Key issues identified after immersions

01

The IT team's delayed responses often lead to escalations and an increase in Turnaround Time (TAT).

02

Unethical practices emerge as agents have unrestricted access to view and edit leads, undermining trust within the system.

03

The GST number field during BA onboarding frequently becomes unresponsive, causing disruptions in the process.

04

The absence of an edit option forces users to manually create new lead IDs for corrections, leading to confusion among employees at a later stage.

05

The sluggish CRM system extends the time required for an agent to input data for a lead, ranging from 40 to 60 minutes, significantly impacting overall productivity, especially when multiple agents share the same PC.

06

The necessity to create new IDs for the same customer in the top-up loan process results in data duplication. This creates confusion, especially with 5-6 top-up loan cases per month. To circumvent mobile number limitations, agents resort to using ghost numbers, introducing the risk of notifying the wrong person.

Key issues identified after immersions

01

The IT team's delayed responses often lead to escalations and an increase in Turnaround Time (TAT).

02

Credit personnel use multiple platforms (CRM, Finnone, Lentra & Galaxy), complicating tasks and shifting processes after APS generation.

03

Default display inaccurately shows no co-applicants in CRM, leading to the creation of unnecessary ghost co-applicants.

04

Credit team relies on emails for document communication with the sales team.

05

Credit team lacks access to crucial vendor technical reports, and documents occasionally remain invisible to the Fraud Control Unit (FCU) in CRM.

06

Initiating technical and financial inquiries in CRM is challenging, and files sent for modification face editing difficulties due to system issues.

Customer service

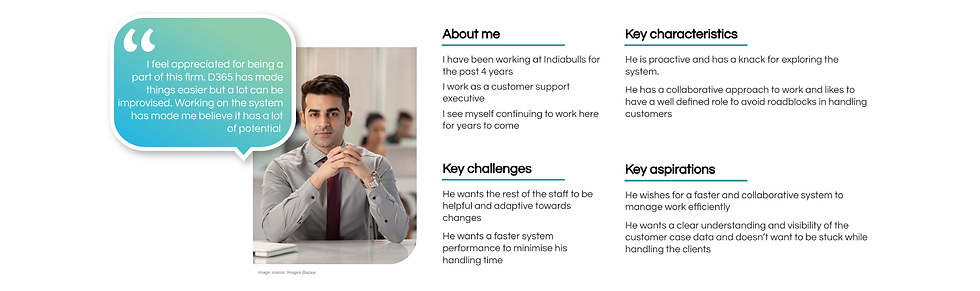

Persona for customer service

Key issues identified after immersions

01

Customer documents, such as KYC details, are exclusively visible in Galaxy. CRM only has access to check addresses.

02

The Payment tab, essential for viewing all transactions with the customer, is absent in CRM.

03

The use of multiple applications like CRM, Ameyo (calling), FinnOne, and Galaxy negatively impacts productivity.

04

Checking email threads with customers on call in CRM is time-consuming, with mail openings taking around 60 seconds.

05

CRM lacks an inbuilt reporting feature, requiring Indiabulls IT to develop various views for report generation. XLS format downloads often don't reflect required data, necessitating manual redoing by managers. Moreover, there is no auto mailer feature for reports.

Research group

Potential future state roadmap

Sales team

Process followed by the sales team

Persona for sales

Proposed solution

Short term fixes

01 | Focus on optimizing views and dashboards for improved loading efficiency.

02 | Implement short-term fixes in Business Rules, Workflows, and JS/Plugin code for best practices and minor/persistent issue resolution. This includes changes to form-level Business Rules, asynchronous workflows, and optimized plugins.

03 | Enable timeline views for historic activities on customers and ensure proper user access.

04 | Restructure Business Units (BU) for improved security management, correct user access, implement training management, and enable a support process.

Long term fixes

01 | Conduct a performance enhancement exercise, evaluating newer integration solutions for optimal system performance and improved data availability across applications.

02 | Introduce more Straight Through Processes (STPs) and focus on gaining deeper customer insights.

03 | Implement Power BI for enhanced reporting capabilities and make necessary modifications to existing processes.

04 | Define new digital ways of working, establish an enabling data and analytics infrastructure, and develop features such as workflow-based approvals, KYC, e-payment systems, and comprehensive report generation.